Risk comes from not knowing what you’re doing.

warren BUFFETT

If I asked the question: Who Wants to be Rich?, I am sure at least 99% of you would say, YES.

But success does not mean being rich. There are many areas people measure success with:

- Being happy

- Being healthy

- Being financially secure

- Having a good career

- Having good relationships

- Able to retire early

Being financially wealthy and is a sure shot sign of success. In fact, 8 out of 10 people consider financial wealth to be a sign of success.

For some of us, being wealthy is easy and for others being wealthy and earning a good income is challenging. For me too, at one point in my life, being rich financially was the top priority. Although, these days that is not my key priority.

But no one can deny the freedom that comes with being financially secure. I have worked hard, read a lot of books, invested meticulously, made sacrifices in order to be comfortable in my finances.

And following are the habits I developed in order to attain a level of financial success:

#1. Put Your Savings in Auto Mode:

One of the easiest way to build your wealth slowly but surely is to save regularly. I was erratic when it comes to saving money in the past. After deliberate reading and understanding, I have come to know that saving at least 10% income regularly into a separate account will work wonders.

Most of us spend first and save whatever is left. Actually it should be the other way around. Save first and then spend. I learned this from Warren Buffet.

A step further is automating this process.

I have instructed my bank to automatically transfer 10% of my monthly incomings to a separate account in a different bank. I only hold a debit card of this bank and I have made it tough to reach this bank account. Every month regularly, 10% of my income automatically goes into this account. I do not touch this money till it becomes a lump sum.

This money is meant as a backup fund for emergencies.

#2. Invest Regularly:

My savings are not limited to just the 10% savings in a low return savings account. I am passionate about investing in the stock market. And if you do not know, stock market returns are some of the best returns that you can ever get.

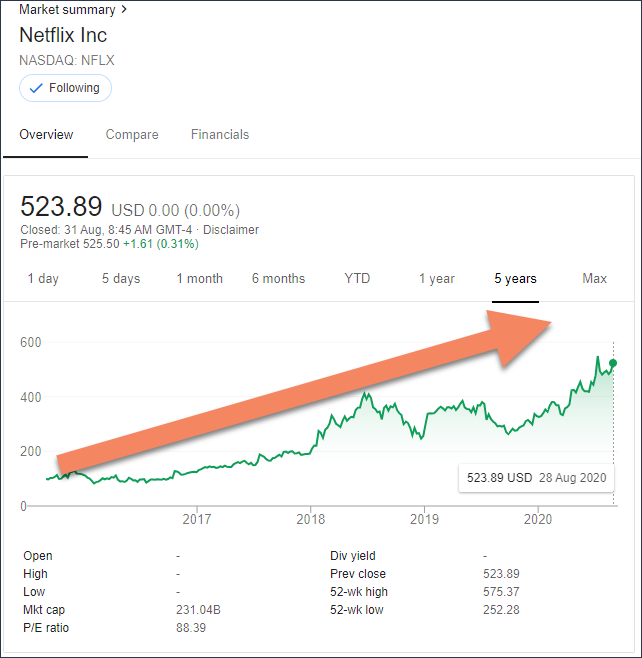

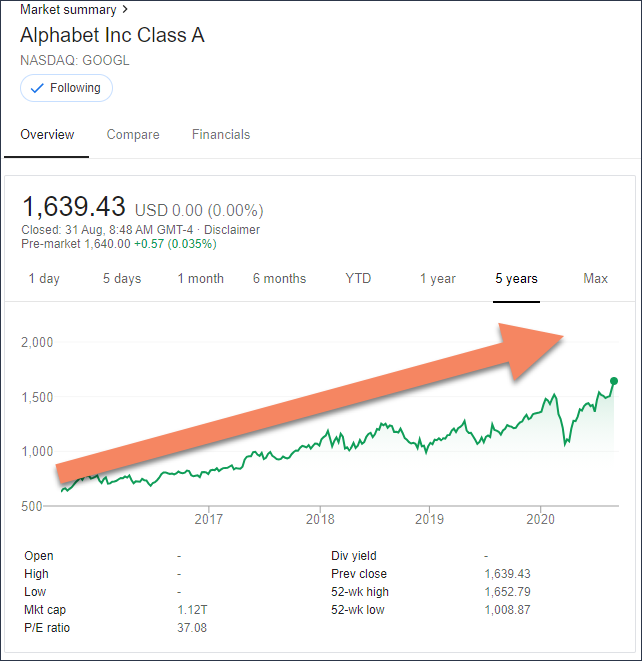

Imaging investing stocks like Apple, Google, Tesla, Netflix 5 years back!!

A tremendous opportunity for investors. Having said that, financial investments are highly risky. Invest only if you are OK losing all your investments. But the returns from stock market can not be overlooked.

Most of my regular investments are in stock market. I am selective in investing is companies that have good management, good financials and growth potential.

#3. Invest Automatically:

This is another great strategy to attain financial success. The best instrument for this is called SIP – Systematic Investment Plan. These are done through purchasing something called a Mutual Fund.

The crux to this product is that you invest in a basket of companies selected carefully by fund managers without taking the risks associated with the individual companies. Although the returns in this case may not be as good as individual stocks, you will reduce the risk of volatility in one stock.

#4. Control Your Impulsive Spending:

Attaining financial success starts with your individual choice. And one the ways to be financially successful is through cutting your unnecessary spending.

Right now audit your day to see where you can reduce or cut spending. During the time of Covid, everyone has surely cut their spending on travel. So, where is this saving going towards? Have you audited that?

Many of us are also addicted to spending impulsively on online shopping sites. Are those spending necessary.

Every penny not spent is saved!

#5. Live Below Your Means:

One of the best things I did to myself was to live much below my means. I live in a modest community of government housing for the past 10 years and in the same apartment. I have not bought a car in the past 12 years. As a family, we own a very modest car (Nissan Tiida). We cook most of our food at home.

This has led to us lot of savings.

You have all the choice to live however you want to. But when at the end of the year when you audit your budget and find that you are breakeven…what’s the point of earning high income!!

I recommend that you live frugally and below your means.

#6. Pay Your Bills Automatically or Set Reminders:

One principle I follow with my finances is to automate as much as possible. It also applies while paying bills. Most of my regular bills such as utility bills, internet bills are automatically paid through my bank account or credit card. Some of you may not have the facility for this. In such cases set reminders at least 3 days before to pay the bills.

This does 2 two things:

- Removes the stress of remembering when to pay bills.

- Avoids late payments

Nowadays there are apps for your mobile which can automatically pay your bills after deducting from your credit card or reminder apps. I set reminders through my Google Calendar to pay bills and credit card dues.

#7. Avoid or Eliminate Debt:

This was a hard lesson I learned. Early on in my career, I was given a credit card by a bank for FREE. I was so excited that I started using it for impulsive purchases like the latest mobile, branded clothes, and so on. That was ok.

But what was not ok?

It is not ok to carry forward your credit card balance. I made the mistake of only paying 5% or minimum payment. The thing with this is, once you get into the habit of paying minimum, the interest will accumulate to such an extent that it will ultimately become a burden to clear this.

Also while taking a personal loan pay close attention to the interest rate. I have seen personal loans at ridiculous rates of 16% per annum. This is insane. Some banks / financial institutes also charge up to 35%.

Just do a simple calculation. Always ask the sales representative to provide you with a payment schedule which contains the principal amount and interest part.

Also, understand the difference between Good Debt and Bad Debt. Good debt is the one which helps you generate more income, like home loan, commercial vehicle loan, etc. Bad debt is the one that takes away your cash flow from you, like marriage loan, foreign vacation loan etc.

If you can not avoid debt, try to reduce it as much as possible. Whenever you have a lump sum amount through bonus or incentive, pay off the principal amount!

At the moment, I am debt free. I do have credit card which I settle every month without carrying the balance forward.

#8: Read About Personal Finance:

I want you do the following, NOW:

- Go back to the start of yesterday

- Calculate the amount of time you have been on your mobile phone browsing FB, TT, IG and so on.

- Consider these dead zone time.

- Check for the last 7 days how much time you have spent on these apps.

- If the number is anywhere more than 2 hours, stop complaining about your sad life.

You are solely responsible for your situation.

Do this instead:

- Install apps like Twitter and follow personal finance experts

- Install Udemy and take a course on personal finance management

- Learn a new skill on Udemy

- Read sites like Investopedia

- (Thank me later)

Time is the most important asset that you have. Depending on how you use your time, your outcomes are determined.

#9. Follow Strict Budgeting:

Budgeting is the cornerstone of your financial success. Period.

I follow a bucket based budget. I have divided areas of my life:

- 10% – Long Term Fund: Rainy Day funds, big purchases, unexpected medical expenses etc

- 55% – Necessities Fund: Day to day operational expenses (food, rent. clothing, school fees etc)

- 10% – Play Fund: Fun part

- 10% – Self Education Fund: Subscriptions, Courses, Coaching etc.

- 10% – Financial Freedom Fund: Savings, Retirement etc

- 5% – Give Fund: Charity.

This method is developed by T Harv Eker and is quite effective. I am not necessarily spending 55% on Necessities. But you get the point. If you are able to budget properly, you will have a lot of your problems turned into opportunities. Budgeting also provides you a roadmap to be strict with your money and finances.

#10. Learn a New Skill that Makes Money (BONUS):

Ultimate financial success is when you’re able to create passive income. Following are some of the passive income media:

- YouTube Channel

- Your Blog

- Stock market investment

- Courses

- Being a coach

See for areas where you are good at. Create some great blog in that area. With consistency, you will be able to create your passive income stream.

While achieving financial success is viewed as a challenge by the majority, I urge you to change your mindset first to believe that it is possible to attain financial success. You have to define what financial success means to you personally.

Once you have a clear goal on where you want to reach, your work is half done. Rest depends on your discipline towards your budgeting and following the checklist I have given you.

Financial freedom is freedom from fear.

robert kiyosaki

Read these Highly Recommended Personal Finance Books:

- Rich Dad, Poor Dad by Robert Kiyosaki

- The Millionaire Next Door by Thomas J Stanley & William D Danko

- Total Money Makeover by Dave Ramsey

If you are interested to listen to Audio Books, you may download these books on Audible.

If you would like to listen to summary of these books, please listen on Blinkist.

Call to Action

If you want to increase your creativity and banish mediocrity, check out my FREE guide called: Ultimate Guide to Be More Creative.

Click here to get the guide right now!