Best ways to save money in Dubai!!

When I decided to come to Dubai, this was my plan:

I will go to Dubai, work there for 5 years, earn a lot of money, save money, come back home and retire into my cozy lifestyle and be happy forever!

Retirement? WHAT?

I dare not think about it. The more you live here, the more you want to live here. It’s kind of like, ‘Hotel California’….’You can check out anytime…but you can not leave.’

If you are feeling the same way as I feel, you are not alone my friend…..there are scores of us. But then if you think this can go on forever, that is impossible. Because at some point of your life you have to retire from work and spend time without earning money, but your expenses will not stop. Chances are that your expenses may rise and you may end up worse. (I am just presuming this. You may be at a better position!) That is why it is very important that you start saving for your retirement. In no way am I recommending penny pinching. Live a comfortable life and also be mindful of your financial position.

Lucky you, if your government supports you during your retirement years; many of us are not fortunate when it comes to government support during retirement.

I am a prudent spender; but when I compared my income and expenditure, I felt that it was high time that I mend my ways. And then I started to streamline my finances. And this post is the result of my efforts to save money.

Who wants to Save money??

Everybody.

My basic money saving mantra is below:

Money not spent is, money saved.

So dive in; the journey is a tough one. But the results are awesome! It only takes a bit of dedication and discipline to get into the money saving habit.

Before you move further, here is a funny meme about saving money in Dubai.

My Favorite, Top and Actionable Ways to Save Money in Dubai:

Save money on DEWA (Dubai Electricity and Water Authority) bill

I believe kitchen and your washroom are the highest water and electricity consumers in a house. So here are few ways to save money in the Kitchen.

1. When washing dishes, do not leave the water running.

You may not realise this, but a steady flowing tap wastes more water than you actually think. Instead fill the water basin with water, wash the utensils and then rinse your utensils with clean water. This saves a lot of water. By one estimate, it is said that a family of four people could easily end up spending around more than 50 gallons of water in the kitchen itself per day. That’s massive!!

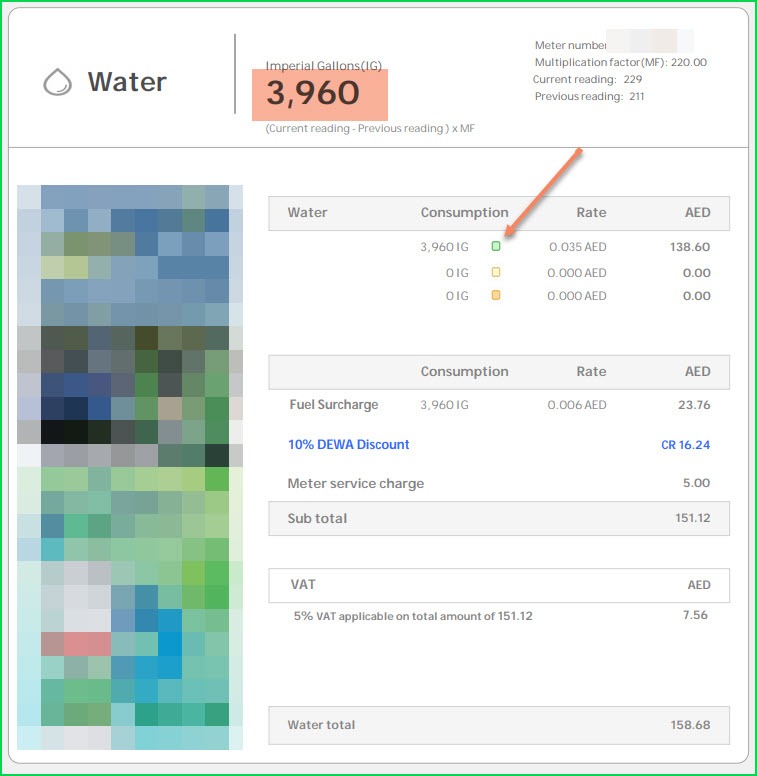

As per my latest DEWA bill, we have used 3960 gallons of water with a total bill of 160 Dirhams roughly. Although in amount wise it is less, but usage wise the water, I feel is higher. Your aim is to stay in the Green area as indicated in the arrow. The charges are higher for higher levels of consumption.

I have read that a dishwasher may do a better job at saving water. But I do not have a dishwasher and can not confirm this.

2. Find and fix the water leakages:

Your house pipes may be leaking a lot of water in places that you do not know. Get an inspection done for the water leakages in the house through a good company. Not only will this reduce your bill, it is also good for the environment.

3. Use dishwasher when it is full:

It may be your habit (if you have a dishwasher), to use it more than once during the day; make sure to fill up the dishwasher before you use it. Over a period of time, you will realise the amount of money that is saved.

4. Buy water efficient devices:

When you decide to buy any devices like washing machine which uses water, make sure to inquire about the efficiency of use of water in these devices.

5. Use low-flow shower heads:

You must know that the newer shower heads use 75% less water than the traditional water. Not only shower heads, replace all your taps in the house with low-flow technology water faucets. Here are a choice of shower heads I selected from Amazon.

6. Use low-flow toilet flap:

A family of 4 easily goes more than 12 times collectively to the toilet and each time you flush the toilet, it uses nearly 4 gallons of water, while older flaps may use more than 7 gallons of water. This easily runs into large amount of water per day. You will have to replace your whole unit for this. Better is to use half the brick and put it in the flush tank or better fill half liter water bottle with water and place it in the flush tank. This makes sure that less water is used , each time you flush the toilet.

7. Reduce time in shower:

‘No one got fairer , cleaner using more shower time’, my hostel warden would say! Reducing shower time would definitely reduce water usage and thus saving money.

8. Use bucket and mug instead of over head shower:

If you are adventurous, you may start using a bucket and mug to take shower. This drastically reduces the use of water. A shower uses 2.1 gallons of water per minute. A 5 minute bath could easily use 10 gallons of water. An average bucket holds 5 gallons of water and when used to take bath, can reduce the water consumption drastically.

9. Replace old bulbs with energy efficient LED bulbs:

It is no surprise that the older the bulbs, the more energy they use. You must replace these older, yellowish bulbs with latest LED bulbs / lights which are energy efficient and also last longer. Fore more information, read about how light bulbs and LED can save you money.

10. Buy energy efficient devices:

Most of the devices like air condition (AC), Refrigerator, Washing machines come with energy efficient label. Take notice of this before you make a purchase decision about these. In Dubai, most of these appliances come with certification through number of STARS. More the Star rating, more efficient is the device.

11. Be an AC ninja:

In UAE, most of us use AC (air condition) at least 9 to 10 months a year. This means these devices are used day and night. And you’d already know that these devices use massive amounts of electricity. They don’t have to! I have become an AC ninja!

While I sleeping I turn on the AC and put it on timer for let’s say 5 hours while a pedestal fan also runs. The AC would cool the bedroom during those 5 hours and for the rest of the 2 to 3 hours the fan would circulate the air throughout the room while keeping it cool. This way, I save a lot of energy hours, which helps me save lot of money on electricity and has become one of the best ways to save money in Dubai.

12. Turn off devices when not in USE!

This is a no brainer! Most of our devices are attached to the wall socket and are using electricity 24/7. This needs to stop as most of these devices do not need this.

13. Your laptops should be put off / hibernate / sleep mode when not in use.

In most of these devices, the default setting to go on sleep mode is to shut the flip. Not only does this require lower energy, it also increases the efficiency and longevity of your devices.

14. Do an energy audit:

I found this the most useful. I took a pen and paper and listed down all the energy consuming devices in the house. Then I went to each of them and saw whether they have been recently used / plugged in. If they are still using the electricity while not in use, I switched off these devices or plugged them off. Two such devices were my music system and computer. Although there is not much noticeable difference, I believe this does make a difference at a micro level.

15. Service you air condition (AC) unit at least once per month:

Dust gets accumulated within the filter of the AC over a period of time and may cause the AC to use more energy to output cool air. Your AC unit whether split or standalone unit needs servicing at least once a month. You don’t need to hire any one for this. You could do it yourself if need be.

16. Install Programmable Thermostat:

Use programmable Thermostat to regulate the temperature in your house. These devices are smart and know when to put the AC unit off when you are not home and how to provide optimum conditions. They save you ton of money over a long period of time and can be effective in reducing the energy bill.

17. Use AC and Fan interchangeably:

In my hall (living room) we have a split unit of AC and we also have a pedestal fan. Whenever the room gets cold, we put the AC off and use the fan instead. Not only does this provide cool breeze, it also helps saving money by using less energy. Adding programmable thermostat will let you automate most of your AC settings. So, if you are using an older version of thermostat, get it replaced with new smart thermostat, to save more on energy and save more money.

18. Put off the temperature button on the Washing machine:

Washing machine units typically have an option to select temperature prior to washing clothes. You already know that for most of us, the tap water itself is already hot and we don’t need hot water for washing clothes. So turn off this option when you start the washing machine. This disables the machine’s internal heating process, saving you lot of energy and money in the process.

19. Replace older refrigerators with new ones:

Older refrigerators use more energy than the new ones while use less. So, replacing your old refrigerators with new, improved, energy efficient ones not only saves you money over a longer period of time, it also provides better space utilisation techniques while saving you loads of money.

Save Money on Etisalat or Du services (telecom)

20. Audit your home telephone service:

Operators like Etisalat and Du, over a point in time provide you services like add on TV channels which you may not need! Thoroughly audit your TV channel plan by talking to their customer care centres and cancel the channels, service which you feel are not necessary.

21. Use toll free telephone calls when calling banks/companies:

I am sure you know that the calls between landlines from Dubai to any emirates in UAE is FREE. So, if you have call someone or any businesses within Dubai or any other emirate in UAE, use this free service to get in touch with most. Be mindful though that numbers starting from 800 are toll free, while for calls to numbers starting with 600 are to be paid by you. Most banks and institutes are changing their number to 600-xxxxxx these days.

TIP: If I have to call a bank or any call centre with 600xxxxx number, I usually look for their landline number (for premium customer care) and use that instead. Hasn’t been a problem till now getting things done!

22. Do you really need that FASTer internet?

Telecom companies may upgrade you from a slower internet to a faster internet speeds. This may be useful if you depend on it for watching HD movies and other stuff. On the other hand, if you use this for only basic things like Facebook, WhatsApp, emails, you may not need the faster internet service. Ask your service provider to downgrade to a lower package and save money.

23. Switch to smart messaging:

Using messaging services like Whatsapp, Telegram will save you loads of money rather than using SMS to communicate.

24. Do you need the data package?

I till date have not subscribed personally to a DATA PACKAGE. I feel this is luxury for me. I could live without it. Besides saving money from not using a data package on my phone, it helps me stay free of smartphone addiction, with regular notifications and an urge to check my phone regularly. This helps me better concentrate on my work rather than being an OCD (Obsessive Compulsion Disorder) on checking the smart phone regularly. Instead, I check all my messages in the evening when I return from the office rather than throughout the day. And believe me, most of us do not have mission critical things to do on Facebook or WhatsApp!

25. Do you even need a fixed line phone?

With Etisalat Triple Play, you are by default stuck with Phone, Internet and e-life services (TV channels). We may be using these very sparingly and the question is whether you actually need to use this? Or are you better off without these services altogether? It’s your choice! Cancelling these services would save a big chunk of your monthly income and help you save a lot of money. If internet is only that you use, grab a data dongle from Etisalat or Du and take them along with you wherever you go. Or better subscribe to a data package and share this with your family!

26. Subscribe to online streaming services like Netflix, STARZ Play and others:

If you must watch movies and soaps, you should consider subscribing to service such as Netflix and STARZ Play. They offer 1st month free, cost just around AED 30 and you can cancel at anytime. I personally use Netflix and is a great source of entertainment.

27. Get a Five Mobile service for International calls:

This card offers fantastic rates and not many of us are aware of this. If you ever need to call outside UAE, it is better to get this service rather than using the expensive normal sim cards. If you are used to talking a lot to your home country, this service saves you a lot of money over time. Note that this service may not be available to all the countries.

Calling rates:

For rates for other countries, read here.

28. Use Skype or Facebook messenger: This again is a no brainer and you may already be using these services. However, did you know Skype also has capabilities to call to mobile phones and landline to any country in the world? If not, you must check it out.

Save Money on Food:

29. Have coffee at home and skip that coffee shop:

Making your coffee at home is a wise choice to getting into your favorite coffee shot. I am not saying, don’t ever go there! What I am saying is to limit your visits to the coffee shop. Over a period of time you will realise how much money you will save doing this. Don’t stop indulging some times on a cup of cappuccino or that Frappe; don’t make it a habit.

30. Cut down on regular eating out:

Dubai has no dearth of place to eat out! Many of us do eat out at the restaurants on a daily basis; may be because of the convenience, work related pressure etc. But this should be avoided as much as possible. A simple meal cooked at home is any time better than the one that you will have at any restaurant. Besides being unhealthy it is also not economical over a period of time. And the money saved here can be used somewhere else more important. If you must go, use services like Zomato to get offers. While you are subscribing to Zomato get 10% discount for using my code: DPK9236

31. Do not throw the left-over food and take lunch to work:

Freeze them instead. This tip comes from a dear friend who cooks for his entire week once, that is on a Saturday and keeps them frozen throughout the week by labelling them neatly for each day. This way he has been able to drastically cut down on the food bill and has gotten more organised in life. Most of the food that is leftover, goes back into the container and has helped him disciplining his lifestyle and expenses. Another place that is a great money leak is the lunch. You probably are the type that likes to order food for lunch. Not only this is unhealthy, it is also not healthy on your purse. Pack your lunch to your office.

32. Use food coupons if you have to eat out:

There would come a time when you have to eat out with friends and family. At this point in time, it is better to use services like Groupon to select your favourite restaurants and use the offers to get the best deal on the restaurants.

33. Drink more water:

Avoid the fizzy drinks that you gulp day in and day out. Other than being unhealthy they cost huge amounts of money over a period of time. It’s ok to indulge in them once in a while; however, they must not be made into habit.

34. Avoid fast food:

We all like going out! It’s ok though….once in a while. Rather than giving in to the temptation of fast food and convenience food, I’d rather eat a home cooked food. The lifestyle in Dubai is such that, the fast food joints are in every nook and corner and tough to avoid temptations sometimes. But considering the health aspects and money aspects, you’d rather avoid them. It’s not tough! I have done this. I try and have home cooked food rather than just placing calls for delivery.

Save Money while Grocery shopping:

35. Never enter a supermarket or hypermarket on empty stomach:

I don’t know the psychology behind shopping groceries on empty stomach, but I have noticed that on 2 occasions when I went shopping on empty stomach, I ended up buying way more grocery items than actually needed. Here is an article that proves this.

36. Shop online for groceries:

Most supermarkets offer online shopping facility and you must use them. Other online shopping services such as Amazon, Carrefour, El Grocer and other online grocery shopping sites in Dubai offer you this service and I find them quite easy to use. Not only does this save you money on many offers, but saves you a lot of time. And ‘time is money’ , right?

37. Audit your groceries:

Before you go for grocery shopping, make sure that you audit your existing grocery to understand what exactly you need to buy. Most of the time tomatoes lie at the bottom of you refrigerator and stay there till they spoil. To save you from this, it is better to check your refrigerator and see what you require to buy. Believe me this seriously has effect on your money.

38. Make a list and stick to it:

Now that you have audited your existing grocery, it is utmost important that before you go grocery shopping you make a list of things you require to buy. Now that you have made a list, go to a familiar supermarket and stick to your list. Do not bother about any offers that are on any item that is available unless you plan on consuming this within a week. Chances are that, if the item is not consumed within a week, it is likely that it may never be.

39. Buy wholesale:

If you were to head to Al Awir vegetable market, you would immediately see the difference in the prices of fruits and vegetables from your next door supermarket. If you are able to buy few items in larger quantities, you must head over there and buy items wholesale. You will notice that this has an immense effect on your money saving capacity and you are less likely to be tempted to the attractions in the supermarkets besides regular shopping. Better yet, you could share the wholesale purchase within your friends who will pay you as per agreement.

40. Visit Karama or Deira fish market for sea food shopping:

This may be inconvenient or time consuming, but it is worth it. Prices are lower and you can negotiate for the best prices here.

41. Don’t fall for “Buy One Get One Free” or “50% off” offers:

This is a classic trick that businesses use to lure you into shopping more. Most of the time the prices are marked up and do you actually need that extra pair for shoes or shirt or whatever you are buying.

42. Visit budget supermarkets:

Lulu, Union Co-operative and Carrefour are known for budget friendly have have whole sorts of products to offer. The quality is same but price may differ from the premium supermarkets. You should make an effort o chose these supermarkets to save more money. While at these stores, make sure to use their reward cards / membership cards to accumulate store points.

43. Buy generic products or in house brands:

If you have visited any of the above mentioned supermarkets, you’d definitely notice that they have in-house brands or generic brands that are on the shelves. These are the brands that may not spend much on marketing, but quality wise they are as good as the premium packed brands and the costs are also much lower on the generic brands. Make sure you buy these brands. There are exceptions here: buy Baby food and similar items from known brands only!

44. Supermarket Loyalty program:

You know about MyClub card from Carrefour and Tamayaz Card by Union Co op? They are the loyalty programs from these supermarkets, which reward you with points which can later be redeemed for in store credit. They are meant to make you loyal to a particular supermarket. However, they can well be used to your advantage by accumulating large amount of points. Many a times they do have offers exclusively for loyalty card holders. Just one thing to note: Because you have the loyalty card, it does not mean you are required to spend much money to accumulate points. Be mindful.

45. Search for items above and below your eye level:

Supermarket shelves are designed in such a way that, at your eye level you will always find brands that are priced higher. You must make an effort to go above and beyond the eye level while scanning for items. Be aware of this situation.

46. Shop in bulk for more than a week’s need:

Your trips to the supermarkets must be minimised as you will end up spending small amounts of money. And when these add up, you will not even realise where and when you spent it. Saving money starts with conscious efforts. To be frank you should set a deadline for shopping time. Once a week, 1 hour, between 10 and 11 AM; set your time and stick to it.

47. Go to supermarket without kids:

Kids and children easily get swayed by plethora of options in the supermarkets. Yes, you must take kids along to educate them about shopping skill; only if you are disciplined. Most of the time when kids ask for something, parents hardly say NO. Every trip to supermarket should be viewed as an expense which can be minimised. And the best way is to limit kids’ involvement is not to tag them along.

Save money – General Shopping:

This category would include all the other type of shopping like rental house, electronics, gadgets, clothes and anything you can think of and does not get into deeper lever on individual items.

48. Don’t shop for pleasure or for time pass:

If you are reading this, you are not a billionaire and may not mind spending as you have unlimited money! For the rest of us, we need to make conscious decision to save money. Most, if not all of us go to shopping mall to shop and we end up buying things that we may not need and most probably because we are bored at home.

49. Track every expense you make:

Do you track your daily expenses? No? Then you may be in real trouble. Some time back, I started tracking each and every of my household expense and it was an eye opener. I thought I was a good saver. But, I ended up most of the months with breakeven of my expenses to income. I thought this was high time for me.

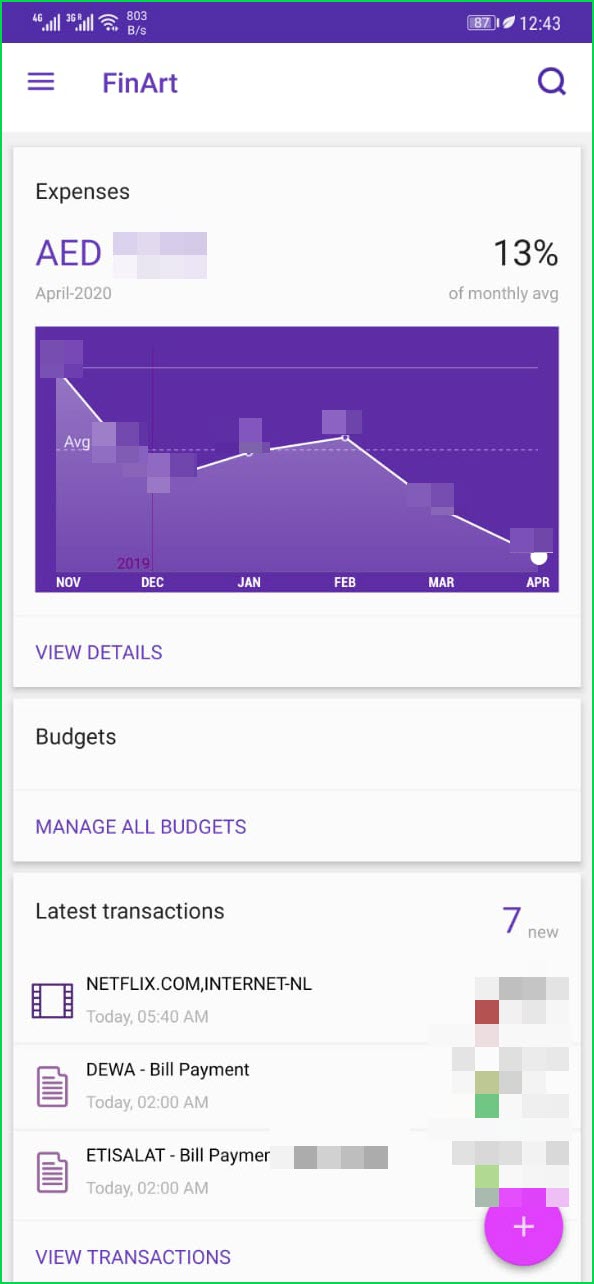

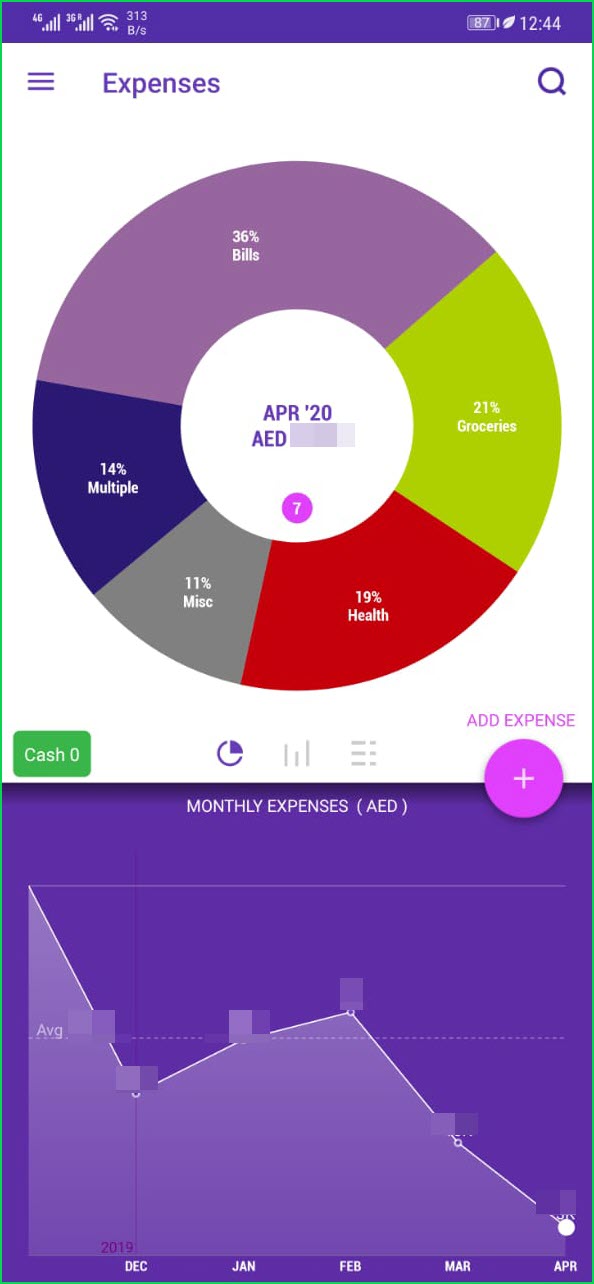

Then I started using an app called FinArt, (available on Android Playstore) to help me track all my expenses. It is a great app. It scans your SMS from the banks and credit card companies and builds a beautiful graph showing every expense. Not only that, it also categorises the expenses, so you know where you are spending and try to budget the category.

Here is a screenshot of FinArt

There may be other apps; do let me know and I will try them out.

50. Budgeting and its advantages:

Who wants to spend time and efforts between writing numbers and analysing them over a period of time?

Neither was I!!

Till the time the it was too late! More often than not, we forget our mission as to why we are in this country. We are here to earn and save money for retirement, children’s education. And without budgeting, I believe, this is an impossible task for most of us. You may be very good at mental maths; but till the time you are disciplined with your budget and savings, I can fairly say that you may not be successful in your mission. If saving money is your mission, stick to a strict budget of expenses. Do not spend more than you have. Do not ever get into deficit while you are earning a salary.

51. How to save money on House Rents?

Many of us are not as lucky to have our own homes and chances are that you have rented an apartment here in Dubai. For many, renting is the best option there is! And you must be spending anywhere between 20 to 40% of your gross income on rents. Now, how can you save money while renting? Here are few tips for you which have worked for me:

- Compare price and area: There are property rental sites like, Property Finder, Just Rentals, Dubizzle which list lot of properties for renting purpose. Compare the prices across the sites and match them with the RERA index for that area. If the rents are not within your budget and not as per the Rera Index, you need to move on.

- Negotiate: Most of hate negotiations, haggling; including me! However, when looking for a property to rent, you must not give way to shyness. Just ask for the best price that matches your budget and you may as well get it. Not only the rent, also negotiate on the commission.

- Deal only with authorised real estate brokerages and landlords. Ask questions or meet the existing tenants.

- Once you choose an apartment, stick to it for a longer term. If you’ve been a long term tenant, chances are that the price increases are very minimal or may not apply to you at all. I have been in the same apartment for the last 6 years and the price increases have been minimal.

- If you’ve been regular at rental payment, make sure to ask relaxation in the number of cheques or payments.

- Moving houses often puts you under a lot of physical, mental stress. Not only that, it is also a stress on your money.

- Look for properties that are directly leased through the owners.

52. Use online price comparison before you decide to buy a gadget:

Well, yes….we all need that one smartphone, that one cool watch, that one cool gadget. But before you run into your favourite mall or an online shopping site, make sure that you check your item’s lowest price at this great site called: Pricena.com. This nifty website compares the price of your favourite item and lists it. You can use this to buy the lowest priced product at your favorite online shop. This is a great tool if you are looking for a great deal online. Note: It is worth noting that while you should use these online shopping sites, be always mindful of your expenses.

53. Use Entertainer Vouchers and Apps to save money:

Entertainer Vouchers is one of your must have book which contains vouchers for Buy One Get One free offers for Food & Drink, Beauty & Fitness, Hotels etc. If you go out regularly, it is worth buying these to save money on various deals. Another best thing is that their vouchers are available in the Entertainer iPhone App and other media.

54. Don’t fall for “The Big Sale”:

There are literally 1000’s of offers running throughout Dubai’s malls and online shopping sites. As innocent it might seem that you can save big on a ‘sale day’, this is a common tactic that is used by retailers to get you to spend. In fact, if an item actually cost 5000 dirhams and you bought it at half the price; you have NOT saved 2500 Dirhams; you have spent 2500 dirhams!! Be careful for such retail marketing gimmicks. I once bought a laptop just because it cost 20% less. And I have hardly used it. Now, it is outdated! This is unless, you NEED the item very much.

55. Cancel memberships you do not use:

Do you remember that gym membership you have taken and never used! I had this experience. While living in Abu Dhabi, I was very enthusiastic to join a gym and improve my fitness level. However, when I moved out of Abu Dhabi, I missed on cancelling the gym membership. I only recalled this after few months, at which time it was already too late. If you have signed up for gym or any other membership and if you do not use any of these services, please cancel these services immediately. This will help you save a lot of money on the memberships which you do not require.

TIP: Don’t sign up for a long term contract.

56. Move out of a larger house to a smaller one:

You may not actually require the 2 bedroom or the 3 bedroom house that you are currently living in. It is better that you move out of it immediately to make way for money that can save.

57. Stop accumulating and start selling:

Over a period of time, we tend to accumulate so many things in our kitchens, bedrooms and it does not stop at that. I think it is human tendency to keep buying things. But pause for a moment and make a list of things that you do not actually need and list them on a classified site like Dubizzle to list your items for sale or for free. It is better to sell the things you don’t need rather than accumulating them at your house.

58. Have house parties rather than going out with friends:

Going out regularly costs a lot of money. With the food, snacks and beverages, it may cost you fortune unless you are in control of your spending. It is better instead to call friends over to your house and spend time together away from the hustle and bustle of the city. Play cards, carom, Uno cards and other games. This is a sure shot way to develop friendship and save money.

59. Spend less on children’s entertainment:

If you have kids, you know the temptations of entertaining them at the mall in the play area! Kids are generally good at keeping themselves busy with activities that you can not even imagine. Let their imaginations go wild. Take them to a park or to the beach (not in the hot sun though!!)….and see how they enjoy themselves. We put too much emphasis on how kids would spend their time. Teach them board games like chess, Ludo, Monopoly, Uno and you will have more time on your hand for yourself and save money too.

60. Before you head out of house:

Make sure that unnecessary appliances are switched off before you go out of the house or on a vacation. It is better if you are going on a longer vacation to turn off the main switch section by section (to leave the refrigerator on).

61. Clear the closet regularly of clothes you do not wear:

Do this now: Head on over to your closet and scan on the clothes that you do not wear. I am sure you have clothes that you do not wear so often and are occupying the space. Clear out the clothes that you do not wear. Donate them or sell them on Dubizzle (if you can, that is!).

62. Invest in quality products. Don’t buy cheap products:

We are often attracted to cheaper products. However, these items are cheap for a reason. They do not last longer. For example, I remember when I was a kid, my dad bought us a first TV it was quite expensive Sony brand TV. It lasted for more than 3 decades! Sure they produce quality products. Whereas we replaced it with another brand of TV which started giving problems within couple of years of production. Buying cheap is not always beneficial and lasts only short term.

63. Do not save credit card numbers on online shopping sites:

While it’s a great utility to have, saving credit card information on e-commerce sites increases your spending frequency, because it is so convenient. Do not save your credit card details on sites. It is dangerous too!

64. Need versus Want:

When you are shopping, let’s say for an expensive product at a shopping centre, use this technique: Ask yourself the question, “Why am I buying this product? Is it what I NEED or something that I WANT?” If your answer is ‘I want’, skip the product. This habit has saved me loads of money. I used to be the one that accumulated a lot of gadgets and accessories starting from DSLR, lenses, stationery, mobile phone accessories and so on. After a point in time, it became a habit . But then I was able to avoid most my purchases with this simple question: Do I need it or Do I want it? Use it yourself and see the difference.

65. Rent out your spare room at home:

Although this is possible, you must first take due note of the current laws in Dubai. Sharing your accommodation is usually not legal. However, it is a known fact that many people share their house or rent out a spare room in the house.

66. Always be aware of your debts and net worth:

Debt is real! There is no denying this. You must then be very much aware of your current financial position in order to plan your life. You must first of all be aware of the value of your assets (home, shares, deposits etc), your liabilities (credit cards, home loan, personal loan) and you must calculate your net worth. Net worth is nothing but difference between your assets and liabilities. Being aware of your net position helps you plan your future effectively.

67. Go for Free events:

Although there are plenty of paid events in Dubai, there are also Free events happening every weekend which can be as fun as free events.

68. Buy regularly used items in bulk:

You know that you will be using the detergent very often. And most if not all supermarkets do store these items in bulk quantity. Buy such items in bulk. These items will cost you lesser as the size increases. I buy washing powder, rice, wheat flour in bulk as I know they are most often required. And I do get good deals on these items.

69. Make saving a habit:

When you get your monthly salary, FIRST SAVE and then SPEND. Invest regularly in National Bonds and any similar saving scheme. I was literally saved by National Bonds investment. You know, I lost my job in 2010. With a family to support, I was in for a rude shock. Although my company was kind enough to give me a generous EOSB package, the expenses do not stop. However, I had made a good habit of saving at least 4000 Dirhams monthly into National Bonds. Over the period of 3 years, this was a substantial amount. I was literally saved by my saving habit. I urge to you to save regularly into such schemes.

70. Pay your bills online:

I like to have more time for myself. One thing I have effectively automated is the bill payment process. Whether it is DEWA or Etisalat bills, my bills get paid automatically. This saves me time and money that I’d spend while traveling, waiting in queue to pay the bill. Not only this, since I have selected to pay bills through my credit card, I end up earning points which I can use for Skyward miles or for any other purpose.

Save money on your Transportation

71. Do you need that big car or a new car?

Dubai is such a place that everyone aspires to have that nice looking car. I remember saying by Edward Norton in the movie Fight Club:

We buy things we don’t need, with money we don’t have, to impress the people we don’t like.

And your car is one of those items. Many of us may not be doing this. But it is time to introspect! Do you really need that lavish 4×4 car? Do you know another thing? Besides the regular EMI, cars and vehicles have other expenses like regular maintenance costs, Annual insurance costs, Annual registration costs, Regular fuel, traffic fines if any, tyre replacement and many costs associated. The higher the value of the vehicle, higher will be the costs of these allied services. Hence, choosing an economical car should be your primary aim while purchasing a car. If you prefer, you could go for a used vehicle, rather than a brand new one.

72. Use public transportation whenever possible:

If you have a convenient location of your house and office using Dubai Metro or RTA buses makes more sense than owning a car. Keep your mission in Dubai at the top of your head.

73. Always drive fuel efficient cars:

When you must buy a car, go for the most fuel efficient cars. Not only do they save money on fuel, they are cheaper to maintain.

74. Regular maintenance of you car saves troubles and money:

I am blessed to have an uncle who owns a garage here in Dubai and he advises in on things to take of of in a car. I have regularly taken my car for maintenance and may be this is the reason why my car has performed well in the past 8+ years i have owned it.

75. Keep tires optimally inflated:

I’d like to mention here that, keeping your tires inflated properly will save both fuel and also extend the life of your tires.

76. Find traffic free time of the day to travel:

You must at all costs, avoid the peak traffic times. Not only it is less frustrating, it will also save you fuel, time and money.

77. Avoid Salik Toll Gates:

Again a no brainer to save money regularly. Also make sure by avoiding Salik, you are not spending more on fuel!!

78. Be within speed limits:

Always pay attention to the speed limits to avoid huge traffic fines. Few years back I received 2 speeding fines worth 1200 dirhams and I still regret it!

79. Drive at modest speeds:

Driving fast and at irregular speeds reduces the efficiency of your car. So avoid accelerating and suddenly reducing speeds. (This must be done in a situation where you may collide with others!!!!)

How to save money with Credit Cards and loans?

80. Don’t ever pay interest to the Bank:

The unwritten law of saving huge amounts of money in credit cards is to pay your entire outstanding prior to the due date of the credit card. If I asked anyone who has been here in Dubai for some time, about their credit cards, the answers would not surprise me as to the outstanding balances they carry on each of these cards. A few years back my situation was the same, I had more than 40,000 Dirhams in credit card outstanding!!! I was surprised how it got there! Then it dawned upon me that I was making partial or minimum due payments to the credit card issuer. I thought this was a huge deal and took a personal loan to close my credit card outstanding and spread my personal loan payment over a year. Now that it is paid off, my strategy on credit cards is to pay the entire amount outstanding on my credit cards. This lets me stay within my limit.

81. Take a Free credit card:

Don’t pay annual fee on your credit card. Take a free credit card instead.

82. Compare credit cards, loans or insurance before signing up:

Price comparison sites like compareit4me.com and souqalmal.com provide you with great comparison tools to compare various bank credit cards and loan products. They also let you apply for these products right from their website and help you get a great deal. Another site I’d recommend is Bayzat.com when comparing insurance products. These sites provide you a neat way to look at and compare various products.

83. Always negotiate on the Loan rates and credit card rates:

Although the loan rates (Personal loan, car loan, home loan) are set, it makes sense to negotiate always on the rates with the sales representative of the bank you are dealing with. With plethora of options available when it comes to banks and finance companies in Dubai. It also helps if you have a good Credit rating as per Etihad Credit Bureau.

84. Ask for waiver of processing fees:

Also do not forget to negotiate on the processing fees for loans. Most of the time they are 1% to 2% of the loan amount. Negotiate this to be waived or to a minimum amount.

For a full list of Credit Card Tips, read the articles in Credit Card category.

Miscellaneous money saving options:

85. Save at least 10% of your monthly earnings:

Make a habit of saving 10% of your earnings regularly. I have opened a bank account where I save at least 10% of my monthly earnings. I do not have ATM card for this account to make it difficult to access these funds.

86. Plan your travel well ahead in time:

Travel and holiday happen to be the top ways after rent that take up a lot of expats’ resources. By planning your holiday well in advance, you will save lot of money on airline tickets and hotels. The rule is….closer the date of your travel, higher the cost!

87. Get the best deal for money transfers:

Before you are ready to transfer the money abroad, make calls to the different exchange houses to see which offers the better rates. It is also wiser to let them know about the amount you are planning to send, so they offer you the best rate possible. Nowadays, banks offer the convenience of sending money through bank website or app. I am absolutely in love with this. You do not need to step outside your house!!

88. Do not carry lot of cash:

One rule of thumb which I follow is that I do not carry lot of cash. I usually have couple hundred dirhams in my pocket. I usually pay through credit card wherever possible. This does 2 things; at the end of the month I get a beautiful tabulated list of my expenses maintained by the credit card company, second, I can keep track of my expenses this way and optimise the way in which I spend my money.

89. Exercise outdoors during cooler times:

Still paying for gym membership in the cooler times? I cancelled my gym membership for cooler months and started using the neighborhood park for walking and exercise purposes.

90: Compare rates of before going grocery shopping:

Before you head out shopping groceries, do a comparison of the prices of the products online. Sallety.ae is the site that provides you comparison of same product across various supermarkets. So next time you decide to shop for certain product, make sure you compare these products.

This site seems to be offline these days. I am looking out for a similar site and will update.

91. Be happy:

Being sad is not good for your money. It is known that out of sadness and boredom, you may end up spending money on shopping to keep away from negative feelings. Always try to be happy and find a routine to keep past boredom.

92. Buy second hand books:

New books usually are expensive. To counter this, look for refurbished or second hand book stalls and buy them. You never know, you may come across a gem! Or better buyer books on Kindle. Books on Kindle are cheaper and you could carry them anywhere easily.

93. Consolidate loans and credit cards:

By consolidation, I mean that you must move away from higher interest loans / credit cards to the lower interest products. This will save you loads of money over time.

94. Stop living for NOW:

Most expats here in UAE are living for NOW without even sparing a thought about future and to save money. A typical behaviour is every week brunches which cost more than 200+ Dirhams a pop, weekend parties at swanky clubs etc. They spend money on gadgets, accessories and so on. The plan should be to avoid living for NOW.

95. Go bargain hunting to the Souqs (markets):

If you are to shop for a product that seems a bit expensive, go to the local markets (souqs) if you must. Or better try and reach the wholesaler or distributor of the product to get the best deal.

96. Ask friends for advice on saving money:

If you have friends or an inner circle, always discuss about your significant purchases, like home, loans etc. Chances are, someone would have a good knowledge about the subject and would provide you with good suggestions about how to save money.

97. Before you buy something new, sell the item that is lying with you:

For a long time, I’ve wanted to replace my refrigerator. However, I thought, until I sell my existing refrigerator, I am not going to get the new fridge. If I did get a new fridge, I’d end up with 2 refrigerators and with no option to discard the older one. It’s been few years, I still use the same fridge.

98. Live a frugal life:

Yes, you are in Dubai! And it is possible to have a balanced life. It is very glamorous and tempting to spend money in malls, cafes, bars, weekends etc; but you need to learn to live frugally and within your means. Having said that, I am not suggesting you to penny pinch. Live a comfortable life but with frugal ways.

99. Try DIY:

Do It Yourself is a popular concept in the western countries. However, with our busy lives here we like to outsource everything here. If your landlord provides free service (like mine!!), you may not have to spend a whole lot on your maintenance of home. Learning to DIY would not only build your skills, it will also save you some money by learning the tricks of the trade.

100. Reduce the usage of Taxis:

Using taxis quite often? Use other public transport modes like buses, metro or ask a friend. When going to an from Airport, you could request a friend to drop and pick you up.

101. Live away from the central locations of Dubai:

While it is glamorous to live in the centre of the city, it is usually quite expensive. Not only the rents, but day to day living costs are higher when compared to other locations. I live 10 minutes away from the Dubai Downtown. But my rents are lesser by 70% than in the Downtown area.

So there you are! I could write 100 more tips to save money. But you get the trick, right! The whole concept is to LIVE WITHIN YOUR MEANS and DON’T BORROW TO LIVE!

This is not all! I will be adding to this list whenever I come across any tips and tricks that can save money.

Do you have a cool way to save up money in Dubai? Let me know through your thoughts below.

Tips from some of my close friends on how they save money in Dubai:

I asked a question to y friends through WhatsApp and I received the following responses:

My Question:

What’s the ONE best strategy to save money in Dubai?

Responses from my friends: I sent this question to around 25 friends. And received around 12 responses. Here are the ones that I thought were good:

Blasius D’souza:

“Refrain from spending from your future income (credit cards, personal loans)”

Cheryl Rodrigues:

“You have a direct debit set up in your account on the pay day; so your hands are tied…and keep a tab on your credit card”

Priya Pais:

“Think about saving before spending…and make sure you at least keep 1/3rd of the salary aside as saving”

Stany Alphonso:

“Keep away from credit cards”

Sneha Barboza:

“Reduce cost of living”

Lee D’almeida:

“Just focus on the basic needs…be within limits.

Steven:

“Say no to credit cards and spend according to your salary budget including other general expenses and deposit a certain fixed amount monthly in your bank account”

Floyd Kiran:

“Avoid making weekly / unnecessary visits to shopping centers. Because it will tempt us to buy clothes, gadgets which are not really important and needed. In that time, you can go to beach, park and can do personal works like washing, cleaning home or can spend that time with your favorite hobby.”

Shelma:

“Send money to India’s account how much ever possible…each month.”

Watch this video:

GREAT INFO & ITS VERY PRACTICAL

Simple and practically possible remedies. organised and neat observations and study. congratulations.

Waoo! great piece, thanks buddy

Good Work DEar!!

a Super blog ! a must read for expats in uae..

was well informed regarding uae dbr,loans, creditcard infos…

Excellent practical suggestions! Wish someone would give me the 101 about investing too!

Really helpful article. I found by chance this website http://shops.ae/. it also has listing of cheap products from different online stores. Might be worth adding on price comparison website.

Thanks for sharing useful information. Everyone likes to save money from shopping. I’m also like to save money and time for shopping. You missed one of the best site for money saving. I’m always preferring the https://saveji.com/ coupon site. It satisfied all my needs, Saveji offering the trending coupons and cashbacks for all categories across all countries. Like lifestyle, groceries, travels, entertainment, etc. By using this site i’m saved my money and time.